Why We Love The South

We love the fundamentals on the South (MSAs) markets. In this article I’ll break down why we like markets in the South, like: San Antonio, Dallas and Houston, Raleigh, Charlotte.

Why do we love Texas & North Carolina?

Every investment has risk, but how do you insulate yourself from risk as much as possible?

I got my start in investments as a Futures Broker, trading highly leveraged futures contracts and options. As my career progressed, I quickly learned how emotions can get the best of you. Gut feelings, and other hyperbole, often lead to confirmation bias; which is a tendency that causes humans to seek information that supports their pre-existing belief.

Let’s face it, you must have a belief about a market or stock if you are going to buy it; but there is vast difference between strategy and gambling.

Whether it be professional investors or professional athletes, there is always a systematic way that they do things. And in the world of multifamily, stringent investing criteria are the key to securing good deals that meet your strict yield and safety guidelines.

Where I have seen investors get hurt the most, is when they are making decision off of gut, following the crowd or jumping on hot tips without some sort of unbiased filter . You should always know your acceptable risk, your target exit price and your contingency plans before you buy anything, because everything else is gambling.

Back in 2009, I had a very large customer who literally nailed the bottom of the S&P 500. The problem was, he was 1 or 2 days early; this meant that he took some heat, and ended up on margin call. Because he had no pre-planned risk, exit and contingency, his emotions kicked in. As a result, he could have sent more money to his account, he could have unloaded part of his position, but instead he dumped everything and guess what, the market never made a new low. And this my friends, is why you must have clear and stringent guidelines for every investment.

Buying Large Scale Commercial Multifamily is no different.

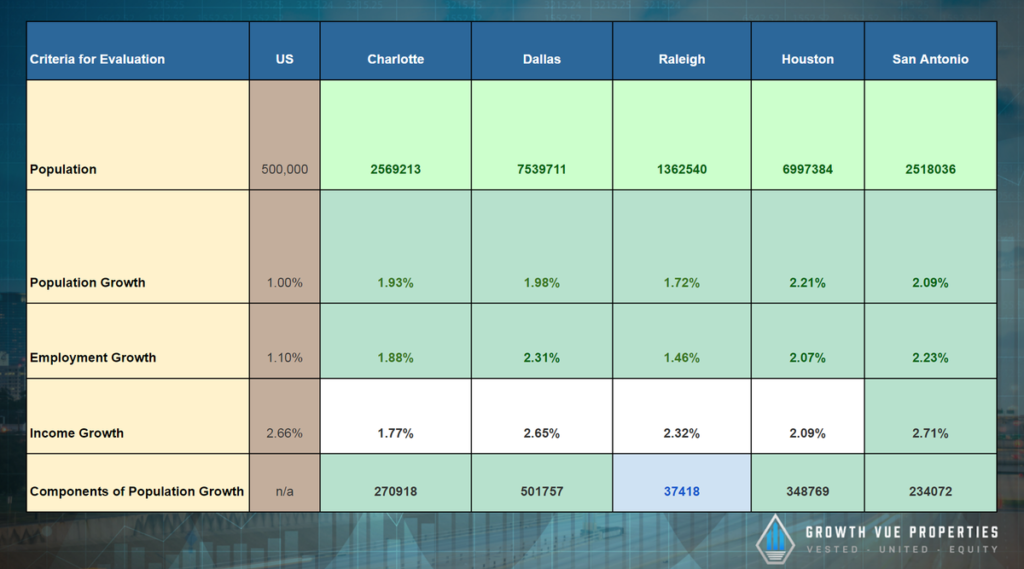

The core fundamentals of the South East Markets are as follows:

- Houston, TX, Dallas, TX, San Antonio, TX, Charlotte, NC, & Raleigh, NC have:

- Large population growth in the last 10 years

- This means that people are moving from other states to live here.

- Strong Job markets

- Low unemployment

- Strong wage growth

- Median income above national average

- Large job type diversity

- Large population

- Large pool of renters

- Business friendly States

- Landlord friendly states

- Large population growth in the last 10 years

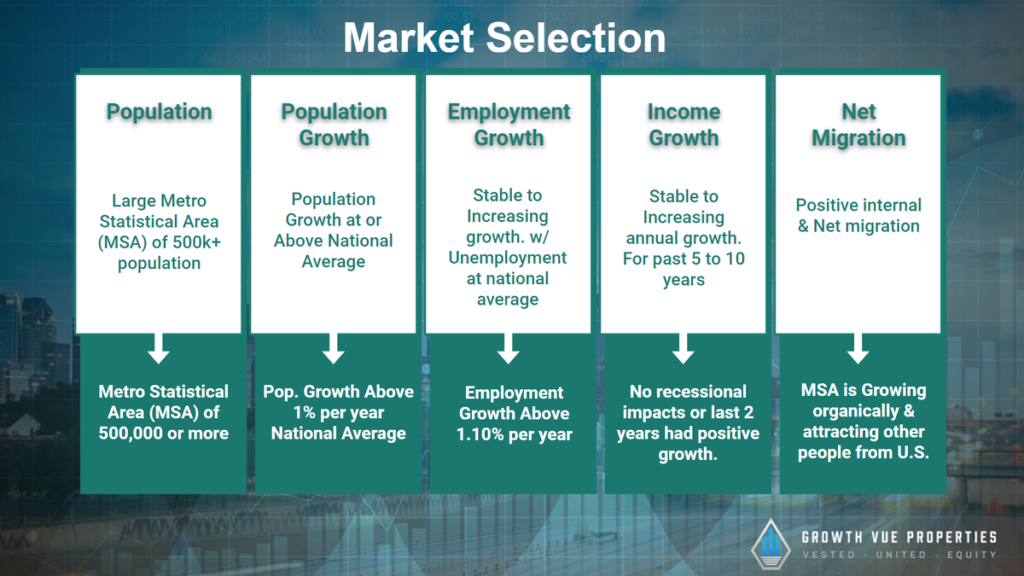

Our very first step, before we begin looking at properties, is we deep dive into each Metro Statistical Area (MSA) and ensure that we like the market itself:

When you combine these core fundamentals with the fact that 51% of the nation’s apartment stock was built before 1980, we begin to see more clearly that there is a need preserve the of middle market properties (i.e. B Class properties). Not only is this the largest segment of housing for working class; but these people who also make up the majority of the economy.

At their core, these are strong markets.

In future posts I will share more insight about the pros & cons of each market and how we adjust our preplanned underwriting to accommodate these factors, before we ever make an offer.

Best,

Samson Jagoras

CEO