Top Multifamily Markets & The Current State

Multifamily has been on a tear through the pandemic. Rents have pushed to record highs, and investor deal volume has been up. We are seeing apartment retention rates are near pre-pandemic highs because renters are staying in place. Apartment occupancies hit an all-time high of 97.1% in August, and single-family is at the highest rental occupancy since 1994! Competition for apartment syndication among investors is growing.

Deal Volume & Competitive Markets

Deal Volume for US commercial real estate assets rose 74% yoy in July and has been above the average pace set for July since 2005. We are going to see 2021 likely end up being one of the best years for multifamily since the financial crisis.

We are seeing consistency in the top popular markets of units delivered and the number of units under construction. The Top 5 cities are Dallas, Houston, Atlanta, Miami, and Phoenix. (source)

Delinquencies

In August 2021, the Trepp CMBS delinquency rate dropped to its lowest level in six months. After several months of largely moderate improvements, the August figure represented a significant drop.

Following two massive increases in May and June 2020, the rate has now declined for 14 months in a row. In August, the delinquency rate was 5.64 percent, down 47 basis points from July’s figure. The percentage of loans that are 30 days past due is 0.41 percent, down 10 basis points from the previous month.

2.42 percent of loans in the grace period missed their August payment but were less than 30 days late, according to the balance. This was a month-over-month decrease of 51 basis points.

Our Focus

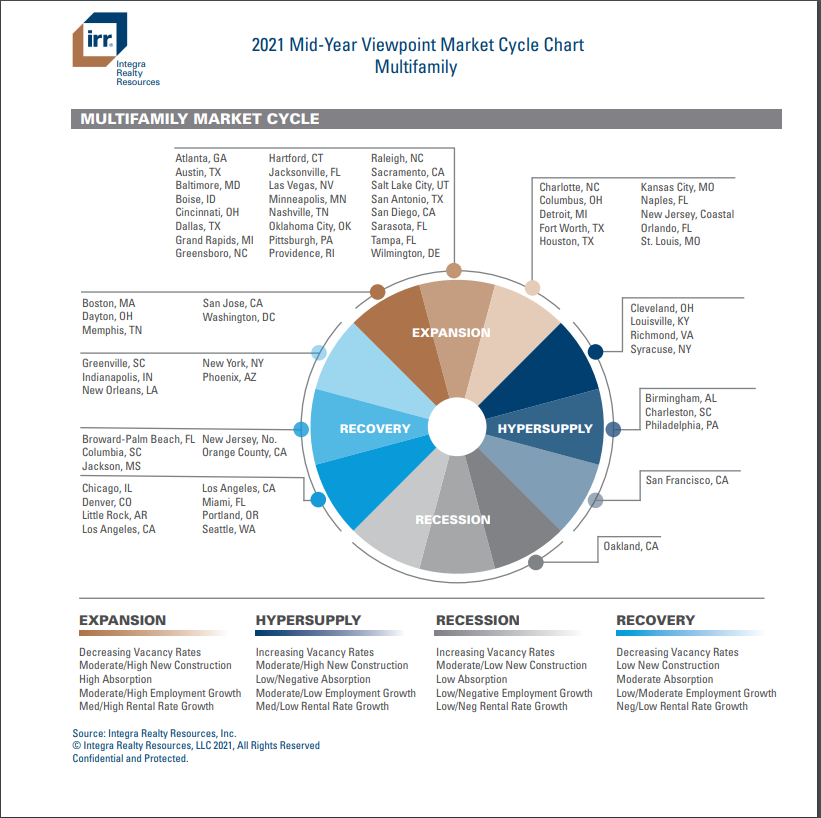

At Growth Vue we have a focus on the expansion areas within the graph of the multifamily market cycle. These areas are med/high rent growth, moderate to high employment growth, and decreasing vacancy rates.