Opportunity in the Midst of Chaos

Over the course of the last two weeks, we have experienced extreme levels of volatility in our economy, society and the stock market.

The threat from a systemic spread of the coronavirus and the resulting disruptions to supply chains and consumer demand, combined with the oil price conflict between Saudi Arabia and Russia, sent the US equity market in to a tail spin. More specifically, the S&P 500 declined 19% from it’s all-time high on February 12th and on the same day, trading was briefly halted for the first time since 1997.

Opportunity in the Midst of Chaos

Over the course of the last two weeks, we have experienced extreme levels of volatility in our economy, society and the stock market.

The threat from a systemic spread of the coronavirus and the resulting disruptions to supply chains and consumer demand, combined with the oil price conflict between Saudi Arabia and Russia, sent the US equity market in to a tail spin. More specifically, the S&P 500 declined 19% from it’s all-time high on February 12th and on the same day, trading was briefly halted for the first time since 1997.

Meanwhile the 10-year Treasury yield briefly touched an all-time low of 0.318% in overnight trading, and WTI crude oil shed broke below $30 a barrel (50% off its 52-week high of over $66 a barrel).

As of yesterday (3/12/2020), we experience the worst day since Black Monday in 1987; and today the President declared a national state of emergency.

What now?

First and foremost, stay calm.

Are we actually surprised? If you have been following our content, you know that for the last 2 years I have been banging the table – Winter always comes!

You never know why, what or how; but like clockwork the market corrects every 8-10 years. And 30% corrections in the market are actually natural and healthy. But the correction in the stock market also highlights the appeal of alternative investments. In only 2 weeks, the stock market has given up the past 2 years of gains.

A recent Preqin report indicates, investors are planning larger allocations to alternative assets with at least 77 percent of investors expected to maintain or increase their capital commitments across alternatives in 2020 and 81 percent over the longer term.

Alternative assets under management have swelled to more than $10 trillion as investors seek diversification and yield, according to the report.

Why?

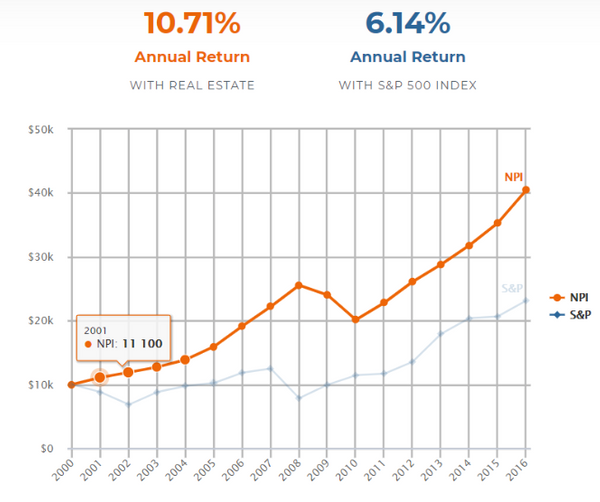

Commercial multifamily investments have proven their worth over and over again. Since 2000 real estate ownership has almost doubled that of stock ownership. Not only has it out performed stocks but it is less volatile as well as a reliable hedge against inflation.

Multifamily investments are a great way to mitigate risk and diversify your portfolio. In the past 20 year commercial multifamily real estate has proven to have the best risk adjusted returns when comparing it to any other asset classes including the stock market, bonds, and other real estate asset classes.

Demographics

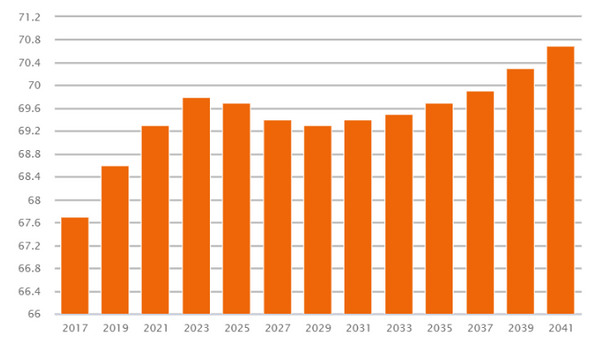

Additionally, multifamily investments are not determined by eight to ten year economic cycles. They are controlled by demographic cycles that last 30-40 years long.

- The largest age group that rents is 20-34 year olds

- There are over 67.5 million people aged 20-34 in U.S.

- Currently, 60-70% of those people rent

- These numbers are expected to grow for the next 30 years

How should I consider re-positioning my portfolio?

One reason for incorporating alternatives into your investment strategy is to build a diversified portfolio whose more consistent return pattern will better withstand the fluctuations in market cycles. Alternatives may help to achieve this goal primarily through the generation of strong returns that are often less correlated with traditional equity and bond markets. Correlation refers to the degree to which investment valuations fluctuate relative to one other.

According to a study from PWC, North American pension funds specifically had the largest allocation to alternative investments at an average of 31%. The process of determining which mix of assets to hold in your portfolio is a very personal one. The asset allocation that works best for you at any given point in your life will depend largely on your time horizon and your ability to tolerate risk. We encourage you to revisit your investment strategy, and consider adding alternative investments, especially given the current market dynamics.

The good new is, if you are receiving this email, you are one of the few, who was ready and waiting for this opportunity to happen. Congrats!

If you would like to schedule a call to further discuss alternative investment opportunities or any other questions you may have, please schedule a time to talk.

Sincerely,

Samson Jagoras

970.402.1787