Investors must be selective with Apartment Rents at All-Time Highs

The markets are taking a breather. Every investor was a genius in the last few years when all markets were on the rise, and now investors have to use better judgments before making investments with their hard-earned capital.

According to Yardi’s analysis, apartment demand has started to decline in several Sun Belt and Western metro areas, with occupancy rates falling in seven of the top 30 metro areas.

In April 2022, the most recent month for which data is available, Las Vegas saw the biggest fall, with a 1.1% year-over-year decline to 95.1%. Phoenix and Sacramento experienced a -0.7% decline to 95.5% and 96.7%, respectively. Greater metro areas that had a loss of occupancy during the epidemic are currently rebounding. All boroughs of New York are occupied at 97.5%, San Jose at 95.5%, and Chicago at 95.4%.

The performance of month-to-month rent growth has somewhat retreated from its most recent peak in October 2021, when rentals increased by 1.5%. Multifamily rentals increased on average by 1.1% from April to May 2022, 3% over the preceding three months, and 13.9% so far this year.

Along with traditional multifamily, single-family built-to-rent growth increased in May, reaching 12.7% yearly. Yardi only includes build-to-rent developments with more than 50 units in its single-family rent measurements.

Should renters renew leases?

According to RealPage statistics, renters who signed new leases in May paid, on average, 19.5% more than the unit’s prior occupants. This is a sharp increase in new lease rate increases from a starting rate of -3% in 2021. Locally, the Miami market sets the bar for new lease rate hikes with an increase of 34.2%.

Apartments in classes A and B are experiencing higher rent hikes than those in classes C. Class A and Class B tenants paid nearly a 12% premium on their rent to renew their leases in May, while Class C renewal rentals increased 7.9% among those who opted to stay in their apartments.

Some spectators are pausing in response to the influx.

New Apartment Supply

Even if prices are rising, there will soon be enough new units to match demand, which will probably have an influence on apartment operators’ pricing power.

According to a RealPage report, construction activity has increased more than sevenfold in the nearly 12 years since the most recent low point in U.S. apartment construction volume, which was around 100,000 units in late 2010. As of the first quarter of 2022, 760,000 new units were under construction. This will boost the supply of apartments by 4.1% when it is all said and done, making it the greatest building volume ever seen in the United States.

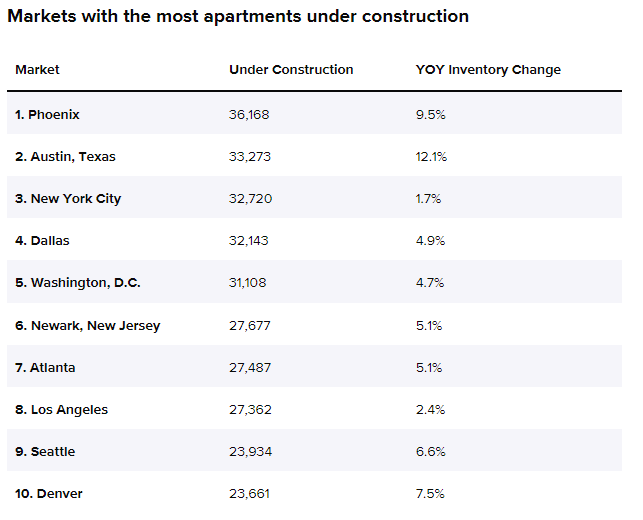

According to RealPage, the Sun Belt and Mountain/Desert metros are among the top areas for new building because of their strong in-migration rates.

Although the annual pace of multifamily permits is up 16.3%, the annualized month-to-month rate decreased by 0.6% from March to April 2022, bringing the total number of additional units approved in the previous year to 656,000.

With 38,366 new multifamily permits, New York tops the country, an increase of 10.7% over the previous year.

At Growth VUE we are seeking deals in markets with great population and job growth. Join our investor list and stay up to date with high-quality multifamily deals.

Apply to Join the Investor Network

New investor form