Higher Yields impact risk assets, multifamily a safe haven

This last week we had a 40-year high inflation print. The stance our nation’s leadership has shared that “inflation is slowing” seems to be bullocks. There are some things happening that are clearly causing concerns for investors. We have seen massive swings in the Nasdaq tech stocks, crypto (partially caused by Celcius pausing all withdrawals for potentially being insolvent, leveraging stETH through Lido and holding 150k Bitcoin)

TLDR: Risk on gets hit hard when there is fear in the market. Everyone is a genius in a bull market.

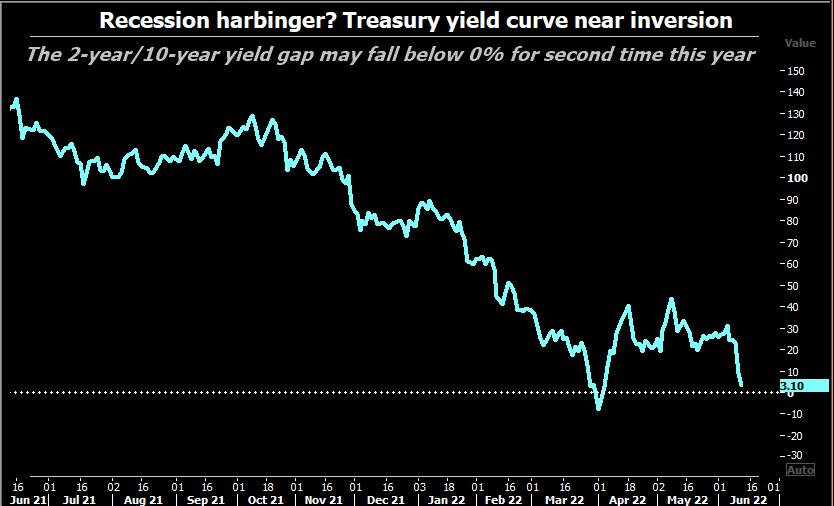

All of this and fears that the Federal Reserve could opt-in for a more significant rate hike than anticipated sent the 2 and 10-year yields to the highest levels since 2007. See below for a screenshot of the inversion of the 2 and 10-year yields. This is viewed by many as a reliable signal that a recession could come in the next year or two.

This poses risk for all investors who have exposure to risk on markets and makes safe havens like multifamily tremendously more desirable than they already were!

Multifamily to weather the storm

Rate hikes make homes unaffordable for most Americans. While some mortgages are cheaper than rent, many buyers are getting priced out of purchasing homes and this puts demand pressure on multifamily living.

We have seen a shift from a seller’s market to a buyer’s market in the multifamily space. This creates lots of opportunities for passive investors. If you are patient, you will find the right deal. We have been waiting patiently for a market turn just like this one, our thesis has not changed.

What exactly is happening?

Multifamily asset sales have been brisk in recent months, but rising interest rates have put investors in a dilemma.

According to the Wall Street Journal, negative leverage in the industry is as prevalent as it was during the subprime crisis. Defaults on apartment-building loans skyrocketed as a result of the crisis.

The term “negative leverage” describes when the interest rate on a multifamily building’s or portfolio’s mortgage rises to a point where landlords make less money on the assets than banks, despite carrying a higher risk.

The Takeaway

Now is the time to be patient and wait for the right deals. Over the last decade in this melt up everyone was a genius. Times are not as easy and investors have to be intentional about where they place capital. If you are new to multifamily check our “introduction to multifamily” webinar. Join our investor list below and learn more about how Growth Vue can help you over the coming years as we all work through this economic downturn.