Builders shift to commercial multifamily due to economic resiliency

In the United States, rising mortgage rates are depriving prospective homebuyers of the option of purchasing their first home, which is driving families to live in multifamily apartments. While this is unfortunate for first-time home buyers, and those having to relocate for work opportunities, this provides a great opportunity for investors who want to invest in multifamily apartments.

In August, new construction of multifamily properties-which containing rental units increased 28% to its highest level since 1986.

The number of single-family homes available for purchase inched up just a little bit in August, from a two-year low, but construction starts have decreased by roughly 30% since late 2020 when the desire for large homes and outdoor space was stoked by low mortgage rates and the growing popularity of remote work during the worst of the epidemic.

Borrowing costs make a nation of renters

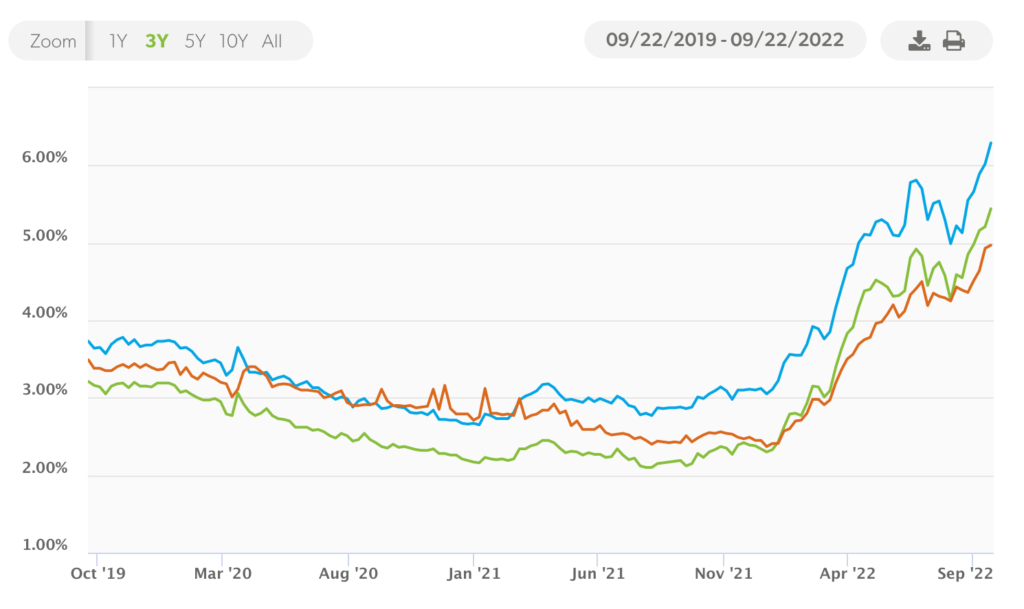

Since then, borrowing rates have more than doubled as a result of the Federal Reserve’s aggressive interest rate hike strategy, which is anticipated to continue on Wednesday with another 75 basis-point increase. For the first time since 2008, the average rate on a 30-year fixed mortgage exceeded 6% last week.

Single-family home sales and builder confidence are suffering as a result of rising rates and rising costs. New construction of multifamily apartments will good news for renters, who have been particularly hard hit by inflation nationwide as there will be more units online for renters.

Massive Shortage of affordable housing

In the U.S., there are 36.8 million apartment residents living in 21.3 million apartment homes. According to the report, approximately 266,000 new units must be built every year to meet the demand.

According to the full study, apartment demand will increase nationwide, by state, and in the top 50 metro areas from 2022 through 2035. In this estimate, the homeownership rate is projected to increase by 3.8%, as well as immigration. Immigration rates are at a record low, but a reversal of this trend could significantly raise apartment demand, according to a press release on the report.

Average interest rate highest & rising costs

With the average home mortgage interest rate at 6.7% and no signs of a dovish turn, it is likely rates could continue to rise to make multifamily even more attractive for individuals and families.

These factors along with rising product costs and economic uncertainty create a strong case for our thesis of investing in affordable midwest and sunshine state housing.

Lastly rising gas prices and the rapid depletion of our strategic reserve apply pressure for those who need affordable housing.

REINFORCING OUR FOCUS

Both before and after the pandemic, Growth Vue Properties has remained laser-focused on value-add commercial multifamily investment properties. Last month GVP provided two offerings for investors that can provide stong and stable cash flows, as well as tax incentives, for investor that are wary of the volatile stock market and the volatile single-family home market.

Our investor portal allows you to view our latest deal in Des Moines, Iowa, as well as our other deals. Register HERE to view the deal flow.

Here are a few key stats on our latest Des Moines deal:

Population 877,991

- #1 Fastest Growing Midwest US Metro, U.S. Census Bureau 2020

- #2 Safest Place to Live, U.S. News and World Report 2021

- #3 Largest international insurance center in the WORLD

- #1 Place with Good Jobs and Cheap Housing, Investopedia, 2021

- #7 Top Emerging North American Tech Market, CBRE 2021

- #5 Best Place for Business and Careers, Forbes 2019

- #5 City to Live in After the Pandemic, NMHC 2022

Join our investor network below so that you can be up to date on all deals that Growth Vue takes part in. Our team would love to partner with you on your investment needs.

Apply to Join the Investor Network

New investor form