2021 smashes records. 2022 poised for multifamily success

2021 was one of the biggest years on record for apartment demand. It actually smashed the previous record by 66%. This outpaced the prior record across three decades. With demand exceeding 673,000 units. One of our core beliefs remains true, which is that affordable housing is in need more than ever. An incredible stat below showcases that as the supply of apartments has gone up, the vacancy is actually going down. This trend will continue into the rest of this year. Let’s dive deeper.

Interest rates are expected to rise this year in the range of 75 basis points (.75% increase) and will still be lower compared to the historical averages. In 2022 there is an estimated 426,000 apartments to be built. This is going to be a historical year and the first time we have seen supply top the 400,000 unit mark since 1987.

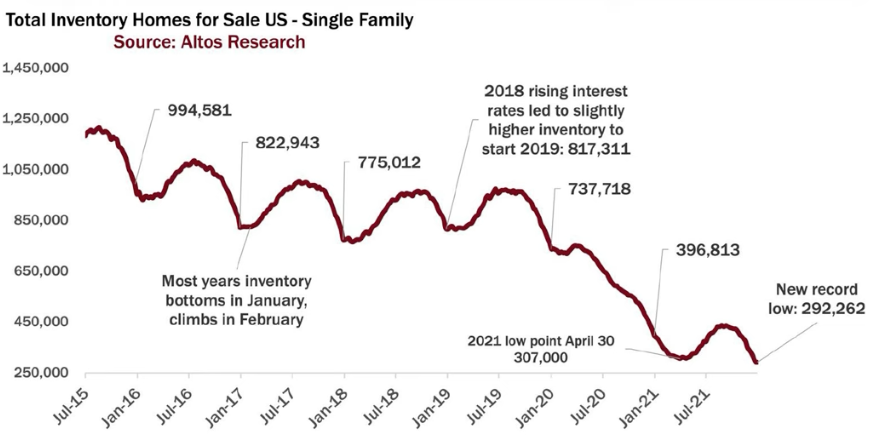

There is also severe demand for single-family homes and some of the lowest availability historically as well. The demand is being seen across all cities at nearly all price points. See the data below from Altos Research.

2022 demand showing no signs of slowing down

With such high demand across the board in city centers and suburbs alike, our investment thesis stands true as well: secondary and tertiary markets across America are poised to outperform during 2022.

No longer are the urban city centers the core of growth. It is shifting and expected to be in the Midwest and Southeast.

The pandemic caused some migration habits to change in 2020 towards secondary and tertiary markets and we are still seeing that shift happen today. Affordable workforce housing will remain at the center of demand for renters, which allows us to create value and return for our investors.

Our mission stays laser-focused on seeking affordable housing opportunities with room to add value. Working-class communities desire up-to-date living, and we aim to bring that to life at an affordable price while bringing returns for our investors in a tax-efficient way. We do this by making exterior improvements like paint, signage, landscaping, repaving parking areas, and updating the lighting. For interior improvements, we pull up old carpet and use durable vinyl floors, new countertops, new appliances, new LED lighting (energy efficient), and low-flow toilets (energy efficient). We provide additional amenities to working families like playgrounds, dog parks, laundry, and community areas.

We have screened over 18 billion in years during 2021, and we will screen more in 2022. In the first two weeks of January, we have flown to inspect three promising OFF-MARKET property deals that we are getting specially delivered to us before going to market. We refuse to overpay for a deal and will continue to work as a steward and allocator of capital for our Limited Partner investors.

If you would like to be an investor in one of these lucrative investments, please contact the Growth VUE Properties team by clicking the button below. We look forward to adding you to our elite group of passive investors!