Midwest Multifamily Demand & Our Latest Iowa Deal

With proportionally strong demand, the U.S. multifamily market has experienced a record-breaking rent rise thus far this year. The economy’s present turbulence, which includes increasing interest rates and inflation, will most likely soon begin to have an impact on the sector’s rapid development.

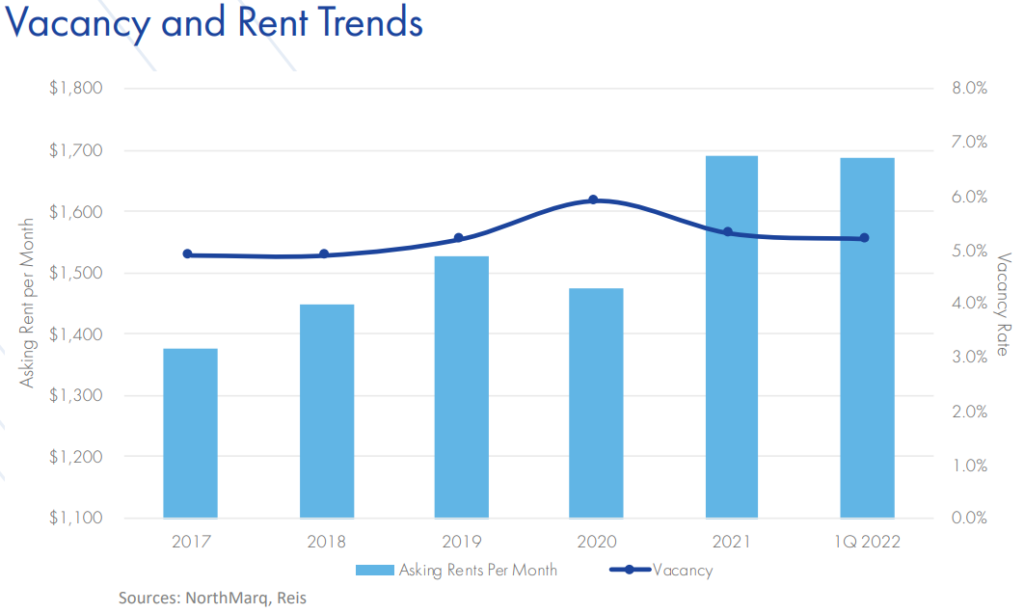

But when compared to other American regions, the Midwest multifamily market offers some clear benefits. In all of the major Midwest cities, the vacancy rates have remained consistent due to a lack of surplus supply, according to recent Northmarq research.

Experts anticipate an acceleration of construction starts in the second half of 2022 despite the year’s weak start.

A breakdown of the report:

As a result of historically low mortgage rates and record-high capital competition for Midwest multifamily developments, sale prices per unit reached all-time highs.

Due to being priced out of the coastal and gateway markets, private equity and national syndicators faced fierce competition when attempting to invest funds in the Midwest.

As a result of the lack of overbuilding in the Midwest in recent years, vacancy rates have remained stable.

Many developers still find it simpler to purchase property in the Midwest than in gateway cities, and the vertical construction permit procedure is completed more quickly there.

Over the last few quarters, rents in the Midwest have tended to rise. Although a few cities had improvements ranging from 3 percent to over 4.5 percent, the first quarter’s average rent growth was only 2.5 percent. Across the Midwest, the average annual rate of rent rise was 12.9%.

Early in 2022, cap rates had decreased throughout the area, with virtually every significant Midwest market reporting averages around 4.5 percent. The cap rates in these areas would have been closer to 5% and 6% only a few years ago.

Cap rates have maintained in a narrow range despite recent increases in interest rates. Many investors are now switching to low-leverage agency loans in order to get long-term funding since interest rates are predicted to rise.

Although they anticipate capturing their profits later in the hold cycle or upon disposal, investors are willing to endure lower initial yields in the first year.

Our Latest Des Moines Iowa Deal

Our latest offering in Des Moines, Iowa highlights the strength of the midwest. Des Moines has a population of 877,991 and is the number 1 fastest growing Midwest US Metro according to US Census Bureau 2020. It is the 3rd largest international insurance center in the world, with 81 total insurance companies headquartered in the area. Other industries include advanced manufacturing, data centers, agriculture and bioscience, healthcare, and government jobs. It also boasts a growing tech market, hosting data centers from tech giants Facebook, Microsoft, Apple, and Amazon.

Unemployment is at 3%, with employment growth at ~2.7% and population growth at a healthy 15%.

The asset is within 1.2 miles of the elementary school, 1.7 miles of the high school, and within 0.3 and 1.5 miles of Drake and Des Moines University.

Statistics

• #1 Fastest Growing Midwest US Metro, U.S. Census Bureau 2020

• #2 Safest Place to Live, U.S. News and World Report 2021

• #3 Largest international insurance center in the WORLD

• #1 Place with Good Jobs and Cheap Housing, Investopedia, 2021

• #7 Top Emerging North American Tech Market, CBRE 2021

• #5 Best Place for Business and Careers, Forbes 2019

• #5 City to Live in After the Pandemic, NMHC 2022

The Asset

• 136 units – 110 need renovation

• 98% occupied

• 3 miles to Des Moines Central Business District

• Purchase Price: $9.750M

• Equity Raise to Close: $3.4M

• Rehab Budget: $1.1M

You can view the deal online today. The capital raises until September 31st. To get updates on all future deals, join our investor list below.

Apply to Join the Investor Network

New investor form